India’s government appears to have favoured the Adani Group to grow more rapidly than older peers and avoid regulatory scrutiny on potentially serious concerns.

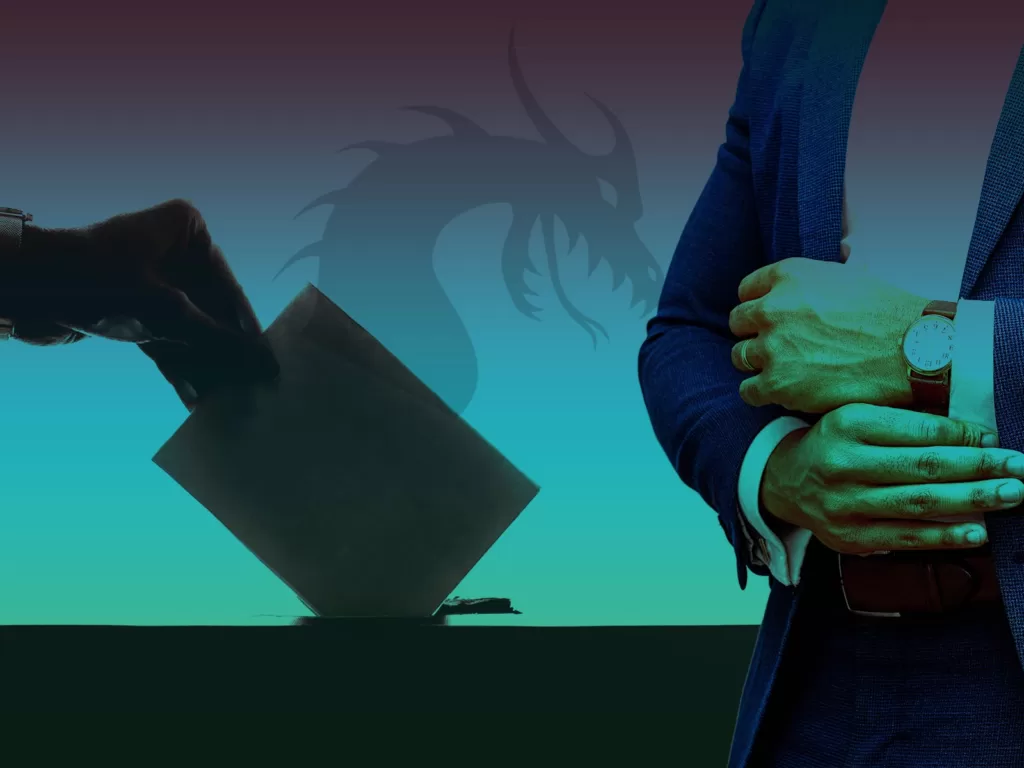

Narendra Modi’s term as PM has coincided with a rise in fortunes for the Adani Group, led by Gautam Adani (right) : Chris Bartlett, 360info.org CCBY4.0

Narendra Modi’s term as PM has coincided with a rise in fortunes for the Adani Group, led by Gautam Adani (right) : Chris Bartlett, 360info.org CCBY4.0

India’s government appears to have favoured the Adani Group to grow more rapidly than older peers and avoid regulatory scrutiny on potentially serious concerns.

The Hindenburg Research report on the Adani Enterprises saga has revealed many proverbial ‘naked emperors’, especially India’s stock exchange regulator, the Securities and Exchange Control Board and the Enforcement Directorate.

The debate on the Hindenburg revelations in January 2023 has focused on the sharp decline of Adani stocks and counter-allegations of conspiracy theories to derail the India growth story. However, this share price correction was a bubble waiting to be pricked.

The Adani saga also reignited age-old debates on crony capitalism, especially in Simon Commander and Saul Estrin’s new book Connections World. Crony capitalism and its significant downsides are not new in India and many other markets.

The ability of Mukesh Ambani’s Reliance Group to extract political patronage and ‘better influence’ from the telecom regulator for its Jio venture — a late entrant to the market which leapfrogged to telecom domination — is a case in point.

Prima facie, the Narendra Modi government appears to have, at least implicitly, favoured the Adani Group to both grow its businesses more rapidly than its older, more established peers (Tata, L&T, GMR, GVK) and to thus far avoid necessary regulatory scrutiny.

An interesting perspective to temper Commander and Estrin’s Connections World critique is to consider the genuine need for emerging economies like India to adopt non-market strategies to build home-grown national champions to achieve global dominance in specific business sectors much like China and the US have nurtured their home-grown tech titans and defence-industrial ecosystems.

The case for building national champions may be even more important given the emergence of a multi-polar economic world of increasing strategic competition between the US and China, forcing India (and other nations) into a complex balancing act to increase their influence and economic opportunity.

India’s central planning authority, Niti Aayog has made the case for actively encouraging a handful of national champions.

Concerns that developing big national champions may be counter to the interests of small and medium businesses are misplaced. There is no apparent conflict between these two segments — the national champion approach is for a few critical industries that smaller businesses have neither capital nor capabilities to deliver on. Improving the opportunities for them is an important but an entirely separate problem.

How national champions are selected and their relationship with the government also matter.

The key principles of transparency, governance, arm’s length relationships, merit-based selection and equitable value sharing among stakeholders are easily articulated but hard to implement.

The most prominent examples come from one-party states (e.g. China, Singapore) and/or where the national champions are effectively state-owned. The US, EU and the South Korean private sector examples are not devoid of corruption scandals.

However, they avoid those private sector companies where the shareholding is highly concentrated in one family or where the corporate enterprises are joined at the hip to the ruling political party, as in the case of Adani.

The national champions approach is relevant for those higher risk, longer gestation, big bets situations where technology is dynamic, mass adoption requires both technological breakthroughs and significant economic efforts and which require geostrategic coordination for establishing new global supply chains.

This approach seems relevant for building indigenous, world-class, ‘critical technology’ industries such as green hydrogen, lithium and other advanced storage batteries or defence systems.

This approach, however, does not apply to regular infrastructure businesses such as building and operating solar energy systems, wind farms, ports, airports, highways, or even data centres – areas where the Adani Group is most active. Here, the project execution risk is far more relevant and the challenge of building India’s infrastructure needs a diversified portfolio of large, well-funded and technically capable players rather than promoting only a chosen few.

Consider that the growth in capital employed by the Adani Group (over 2018-22) is around $USD16 billion, barely 0.1 percent of India’s $USD1.5 trillion infrastructure funding gap. Hence there is no rational justification for the Modi government’s apparent favouritism towards the Adani Group.

Inaction by regulators

The issues to focus on in the Adani saga are the allegations of the Adani Group possibly violating minimum public shareholding thresholds, market manipulation, round tripping and money laundering. The failure of India’s regulatory watchdogs to initially investigate these serious allegations is the most damning implied evidence of cronyism and corruption.

The Supreme Court of India has now intervened and asked the Securities and Exchange Control Board (SEBI) to investigate. It remains to be seen whether SEBI will conduct this investigation in an effective and impartial manner.

The sharp decline in Adani shares after Hindenburg Research’s report created significant noise around the implications for financial/operational distress in Adani companies and conspiracy theories about a plot to derail the India growth story.

The facts are Adani Group’s reputation and the share prices of its entities have fallen substantially. Up to March 2023, Adani Enterprises (AEL) shares fell by 56 per cent from their mid-November 2022 peak. But this decline has to be viewed in the context of its 2800 per cent growth from pre-pandemic levels.

In stark contrast, consider the growth in Bitcoin was around 1000 percent in the same period and the US NASDAQ 100 Technology Sector Index grew by merely 144 percent despite the American market having vastly superior growth narratives and global investor appetite.

Comparing Adani Power with industry peers such as Tata Power’s modest stock growth further underlines this crazy ride.

A return to sanity and gravity was probably inevitable. There may yet be further falls.

However, there are no materially observable signs of financial distress in AEL’s reported fundamental business metrics so far.

Over the 2018-2022 financial years, AEL revenues and total assets have roughly doubled. While the profitability, return and debt leverage metrics have noticeably declined in the past year, none of these are at distress levels and could plausibly be explained by pandemic impacts and the rapid growth in longer gestation new projects which could imply improvement over time.

Sadly, Adani appears to be yet another case of crony capitalism. However, Asian capitalism needs to be, and is, different from capitalism in the West. The higher number of diversified groups and state-owned enterprises is evidence of this.

Going forward, we can expect more state-encouraged national champions. This would require the strengthening of regulatory and governance institutions. However, the trend under the Modi Government appears to be the opposite.

Tejpavan Gandhok is a Vice Dean and Professor of Strategy and Entrepreneurship at Jindal Global Business School, O.P Jindal Global University.

Originally published under Creative Commons by 360info™.