India’s famed basmati rice variety is among the commodities hit by supply chain disruption caused by the Houthi attacks on the Red Sea.

India’s basmati exports are significantly affected by disruptions in the Red Sea. : User sum overseas, Wikimedia Commons CC BY 4.0

India’s basmati exports are significantly affected by disruptions in the Red Sea. : User sum overseas, Wikimedia Commons CC BY 4.0

India’s famed basmati rice variety is among the commodities hit by supply chain disruption caused by the Houthi attacks on the Red Sea.

India’s lucrative rice trade is at risk after repeated attacks on its ships on the Red Sea. Since mid-November 2023, Iran-backed Houthi rebels have been striking cargo vessels — even some bound for Iran — as part of a wider strategy to disrupt global supply chains.

New Delhi is worried its exports of basmati rice, worth USD$3.97 billion in export earnings (for the period April-December 2023), could be hit. On an official visit to Tehran in November 2023, Indian External Affairs Minister S Jaishankar told his Iranian counterpart the attacks were “…a matter of great concern to the international community” and “obviously, it also has a direct bearing on India’s energy and economic interests.”

Jaishankar added that “this fraught situation is not to the benefit of any party and this must be clearly recognised”. The joint statement by Jaishankar and Iranian Foreign Minister Amir-Abdollahian viewed the Houthi attacks as a “perceptible increase in threats to the safety of maritime commercial traffic in this important part of the Indian Ocean”.

The Houthis’ unexpected strikes against Indian shipping on the Red Sea figured high during Prime Minister Narendra Modi’s February 13 deliberations with United Arab Emirates President Sheikh Mohammad bin Zayed Al Nahyan. This happened against the backdrop of the wider geopolitical situation in West Asia.

The Yemen-based Houthis attacks on Red Sea shipping have not only had a significant impact on global trade and oil prices, but also in geopolitics. The US and India took little time to respond, throwing in their navy resources to protect shipping lanes and ensure commercial vessels remained safe against the backdrop of the larger Israel-Hamas conflict.

The Houthis claimed that the attacks constituted ‘retribution’ for Israel’s disproportionate military response to the October 7 Hamas attacks, especially on Gaza.

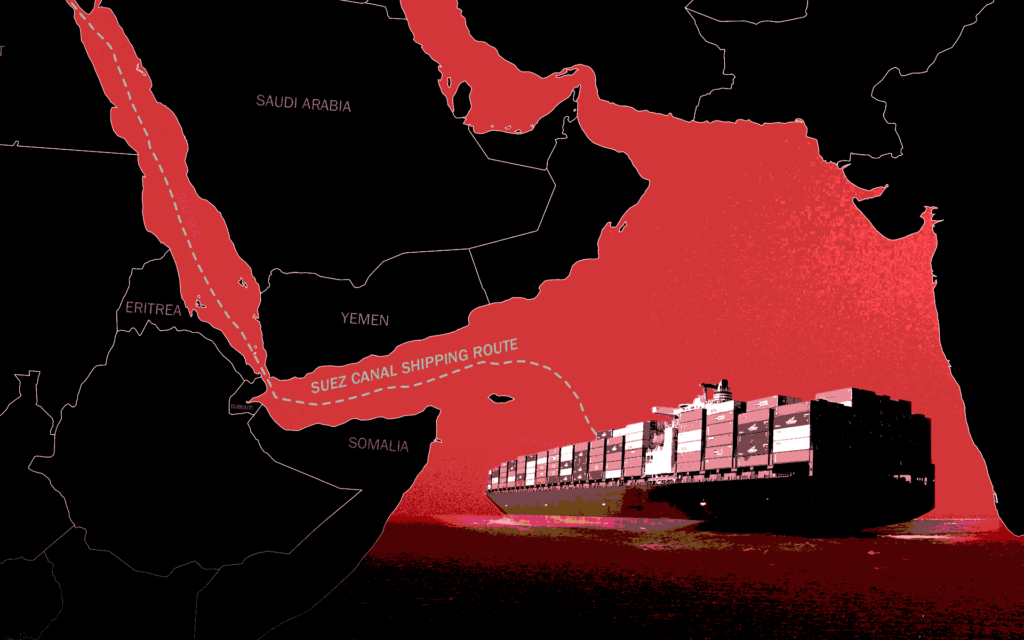

The Red Sea is an important lifeline for the global supply chain and international trade. It connects to the Mediterranean via the Suez Canal, which accounted for an estimated 10-15 percent of global trade in 2023, including oil exports, according to UNCTAD estimates. An estimated 25-30 percent of global container shipping volumes also pass through the Suez.

India’s blue water capabilities have grown remarkably – demonstrated by the Indian Navy’s swift action against Somalian pirates between 2010 and 2024. New Delhi has sought to play a more active oceanic role that is oriented towards protecting its shipping and supply chain interests.

Like all major regional economies, India has not been immune to the financial effects of the Houthi attacks, especially in a climate of steadily rising shipping costs.

Freight costs from Shanghai to Chennai rose by 144 percent between November 2023 and January 2024. Freight costs from India to the US and Europe rose 40-50 percent in some sectors, such as pharmaceuticals and cars, between September 2023 and January 2024.

India’s basmati exports are significantly affected as over one-third of production is shipped to West Asia, Europe, North Africa and North America via the Red Sea.

These regions account for 50 percent of India’s overall exports. The alternate route via the Cape of Good Hope has consequently raised shipping costs.

Just over a month after the Houthi attacks began, there were fears that basmati export prices could rise by as much as 20 percent. While the Indian government did not expect basmati demand to be affected, officials cautioned that prolonged disturbance on the Red Sea could cause a further increase in prices.

Even as all eyes are on rising oil and basmati prices, disruptions to other areas — such as tea, spices, fruits and buffalo meat — are hitting exporters’ bottom lines. Likewise, there are reports of delays in imports of fertilisers, sunflower oil, machinery parts and electronic goods to India. This in turn raises the risk of hitting consumers’ pockets.

India’s concern over disruption in the global supply chain must be understood in the context of the overall international economic impact.

Oil tanker transit through the Suez Canal dropped 23 percent in January 2024 compared to November 2023.

Rerouting petroleum products and cargo via South Africa also resulted in a significant increases in transit time — as much as 10-14 days. Costs have also increased by 30 percent.

Shipping rates from North Asia to Europe had already risen since the beginning of the Israel-Hamas conflict in October 2023, and other routes were impacted.

This could lead to global inflation.

According to a JP Morgan report, if the Red Sea tumult and the spike in container shipping costs continued, core goods inflation could go up by 0.7 percent, while overall inflation could rise 0.3 percent.

There is growing realisation that the Houthi attacks pose a serious challenge to the global economy, especially at a time when it is already in the throes of geopolitical crises in Ukraine and Palestine.

While speaking at the World Government Summit in Dubai on February 12, IMF Director Kristalina Georgieva and World Bank Chief Ajaypal Banga flagged the Red Sea attacks as a threat to the world economy.

The US, which has a significant stake in the Red Sea, has impressed upon China to force the Houthis to show restraint.

China conveyed to Iran that economic ties between Beijing and Tehran could be impacted if the Houthis’ Red Sea attacks continued. However, some analysts suspect China is only preserving its own interests in the Red Sea, limiting the degree to which it will intervene.

States have responded to the Houthi attacks in different ways — finding alternate trade routes or using diplomacy — but no tangible solution has emerged.

India too will likely be impacted significantly, though it remains to be seen how it mitigates the economic damage while searching for a diplomatic solution.

Tridivesh Singh Maini is an Assistant Professor at O.P. Jindal Global University’s Jindal School of International Affairs (JSIA). Maini was earlier a visiting fellow at JSIA, a public policy scholar at The Hindu Centre for Politics and Policy in Chennai and an Asia Society India-Pakistan Regional Young Leaders Initiative Fellow.

Originally published under Creative Commons by 360info™.