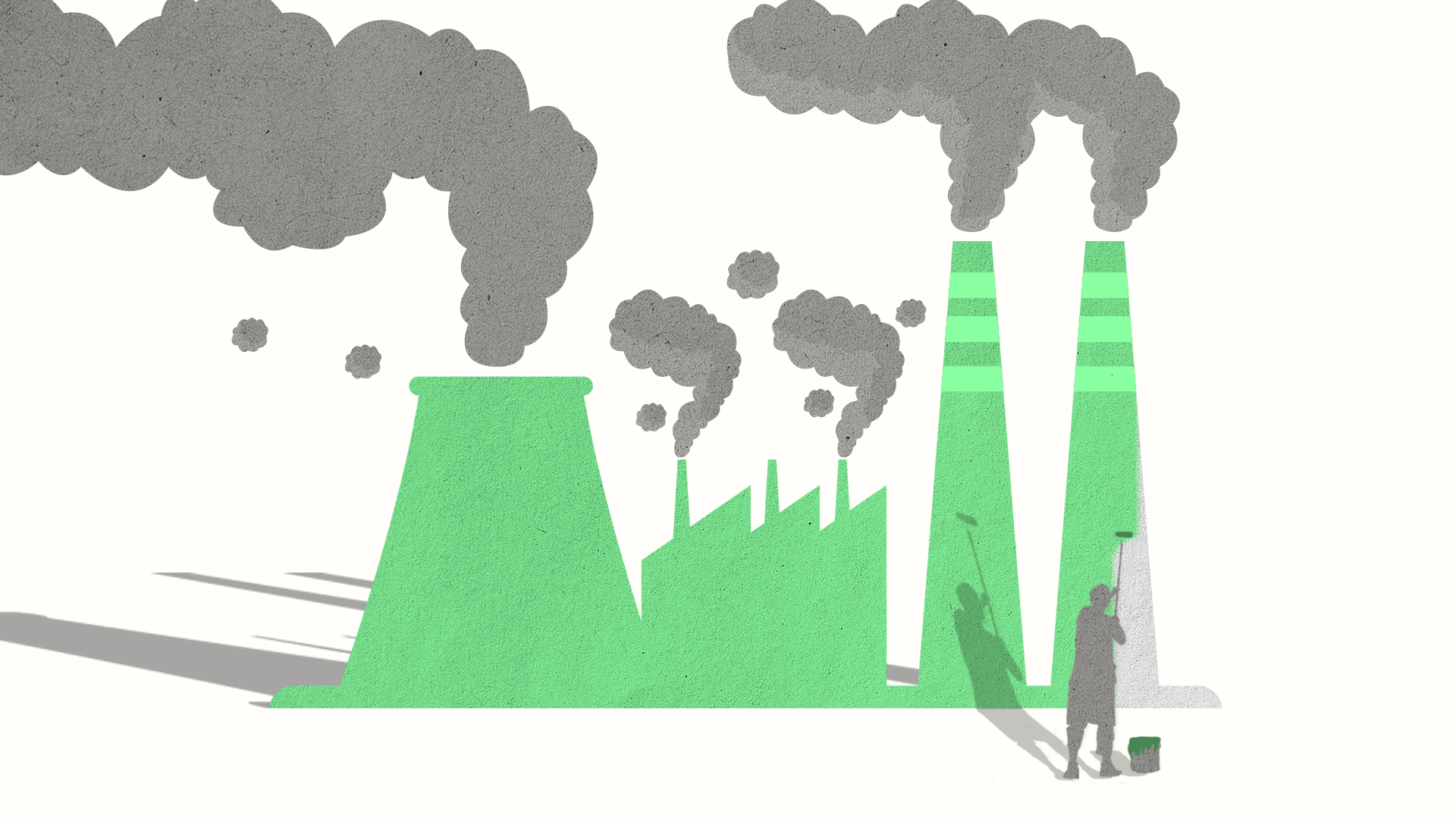

Artificial intelligence is a double-edged sword which can help both enhance transparency or perpetuate false claims on sustainability efforts.

Artificial intelligence holds promise in better curbing greenwashing with its advanced processing power and speed. : Image by Nathana Rebouças available at https://tinyurl.com/2vbcyzum Unsplash License

Artificial intelligence holds promise in better curbing greenwashing with its advanced processing power and speed. : Image by Nathana Rebouças available at https://tinyurl.com/2vbcyzum Unsplash License

Artificial intelligence is a double-edged sword which can help both enhance transparency or perpetuate false claims on sustainability efforts.

The battle against greenwashing is set to become easier with a potential ally – artificial intelligence.

Driven by cold, hard data and emotionless algorithms, it can play a critical role in identifying misleading claims and verifying environmental performance thus increasing transparency in sustainability efforts.

Greenwashing — when businesses make misleading claims to the public about their environmentally sustainable efforts or products — is rampant in markets throughout the world spurred both by profit chasing and increasingly pro-environment consumers.

Until now, such practices were difficult to spot given their intricate nature which often bogged down regulators tasked with proving or disproving the claims.

However, this is an environment in which artificial intelligence thrives.

Identifying inconsistencies

AI-powered tools can analyse stupendous amounts of data (Big Data) comprising detailed company reports, marketing materials and social media content to identify inconsistencies in a brand’s environmental claims.

Natural Language Processing algorithms can detect ambiguous or exaggerated language in voluminous corporate sustainability reports, highlighting where companies might be embellishing or outright lying about their green efforts.

These cutting-edge systems can compare publicly made statements with real environmental data, identifying discrepancies between claims (like “carbon neutral” or “eco-friendly”) and actual real-world performance indicators such as energy use or emissions.

Well-designed artificial intelligence applications can also process real-time data from sensors and Internet of Things devices to track and monitor key sustainability metrics such as a business’s recycling rate, water usage and waste management.

This data can then be cross-referenced with a company’s or brand’s environmental, social and governance efforts.

Machine learning algorithms designed to track climate change, meanwhile, can be utilised to assess satellite imagery to track deforestation, urban expansion or land use changes, verifying if a company’s actions align with its sustainability promises.

AI can boost transparency by making it easier for consumers, regulators and investors to access and interpret complex environmental data.

Blockchain technology teamed with AI can safeguard this environmental data, making it tamper-proof but accessible. This allows companies to create transparent supply chains, verifying that products are sustainably sourced from start to finish.

By combining AI with advanced data analytics and real-time monitoring, companies can also be held accountable for their environmental claims, ensuring that sustainability efforts are genuine and backed by evidence.

Misinformation perfect storm

But while there are many positives AI can bring to overcome greenwashing challenges, it can also be misused by unscrupulous businesses to create the illusion of sustainability. They can do this through slick, data-driven claims designed to hide zero sustainability efforts.

AI could conjure a perfect storm of misinformation. Tools like Natural Language Generation can create tailored, highly persuasive sustainability narratives that sound credible.

Companies could use these tools to craft green claims across various platforms (social media, press reports, advertisements), making it seem like they have robust sustainability programmes when they don’t.

Another area of worry could be AI-driven sentiment analysis which is used to monitor public opinion and adjust a brand’s communication strategies in real-time. On the flip side, it can help companies greenwash by shaping a false online image.

For example, artificial intelligence can be programmed to automate positive engagement around a brand’s environmental initiatives across various social media platforms while downplaying criticisms.

More scrutiny

Regulatory bodies worldwide have intensified scrutiny of greenwashing practices, driven by rising consumer demand for transparency and stricter environmental, social, and governance standards.

While a precise global dollar value for losses caused by greenwashing is difficult to calculate due to varying factors across industries, high-profile cases suggest significant financial impacts.

Last year, the United States Securities and Exchange Commission fined Deutsche Bank’s asset management arm, DWS, $US19 million for ESG violations. The agency has also introduced rules to prevent deceptive fund names from misleading investors about their environmental impact.

Beyond individual fines, greenwashing also leads to broader market impacts, including investor losses and declines in company valuations when misleading claims are exposed.

This report says that greenwashing has been linked to 25 percent of climate-related ESG incidents in 2023, with the global financial sector seeing a 70 percent increase in such incidents.

The European Union has proposed a Directive on Green Claims which mandates companies substantiate their environmental claims through independent, science-based verification.

This directive aims to prevent misleading advertising jargon like ‘environmentally friendly’ or ‘sustainably produced’ unless thoroughly proven. Companies making false green claims could also face fines of up to 4 percent of their annual turnover.

With an estimated $US18.4 trillion of ESG-orientated assets now being managed globally, the United Kingdom’s Financial Conduct Authority has put in place new Sustainability Disclosure Requirements and an investment labels regime that requires all sustainability-related claims to be clear, fair and not misleading.

In Asia, Japan’s Financial Services Agency cracked down on ESG-labelled funds, setting stricter guidelines for what qualifies as green or sustainable. It targeted the $US9 billion Mizuho fund for failing to provide sufficient information about its environmental impact.

It is evident from these regulatory crackdowns that there is greater enforcement over greenwashing claims, with stricter penalties and more detailed reporting requirements becoming the norm.

And it is here that artificial intelligence has its work cut out for it. For whichever side that uses it.

Nafis Alam is a finance professor and the Head of the School of Business at Monash University in Malaysia. His research mainly focuses on financial regulation, FinTech and RegTech. He tweets at @nafisalam.

Originally published under Creative Commons by 360info™.